100%

Ventes B2C

B2C sales

Si vous vendez aux consommateurs (B2C) du vin mousseux / tranquille en Europe, vous devez désigner un représentant fiscal pour déclarer et payer vos droits d'accise et la TVA dans tous les pays de l'UE où vous effectuez vos ventes.

Vente B2B

Vente B2B

If you are selling sparkling / still wine in Europe to professionals with VAT number and no excise one in (B2B) such as restaurants, wine shops, hotels, you can appoint a fiscal representative to help you with your alcohol excise duties

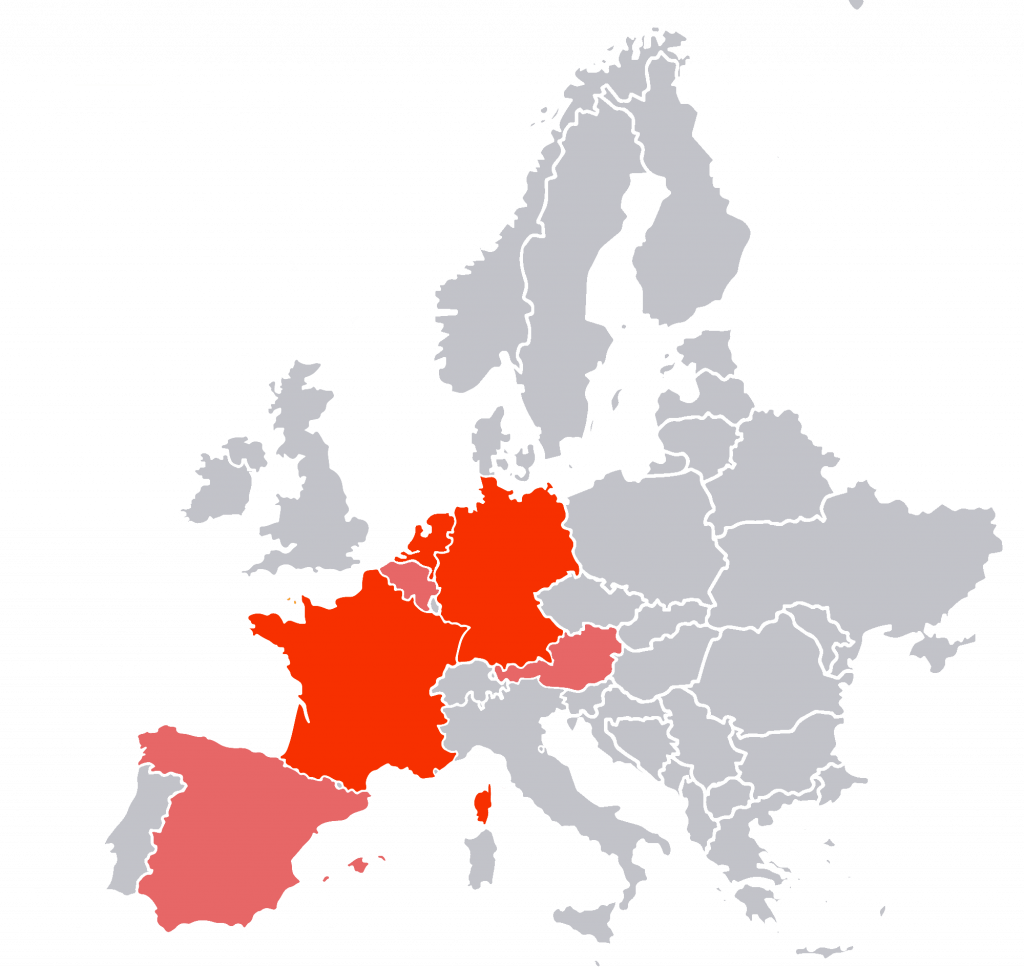

Becompliant for your alcohol excise duties within 6 countries:

100%

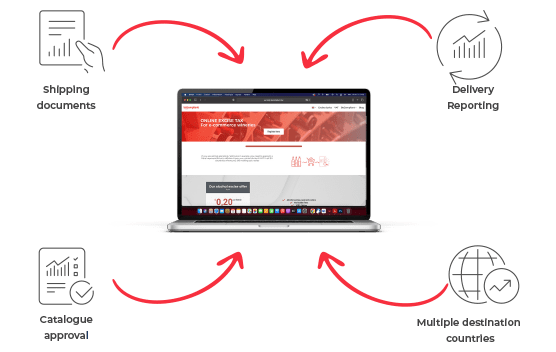

Simple, rapide & 100% en ligne

Inscription & gestion complète en ligne

Our alcohol excise offer for B2C

de

€

0,20

per Bottle

-

Fiscal representation

-

e-cloud

-

Shipment document SAD

- Alcohol excise payments online

- No hidden fees

- 100% Online

- Pay as you ship

- Instant shipment documents

Our alcohol excise offer for B2B

de

€

19,99

per Shipment

-

Fiscal representation

-

e-cloud

-

Electronic SAD (EMCS)

Coming soon

.

Contactez-nous

100%