100%

B2C sales

B2C sales

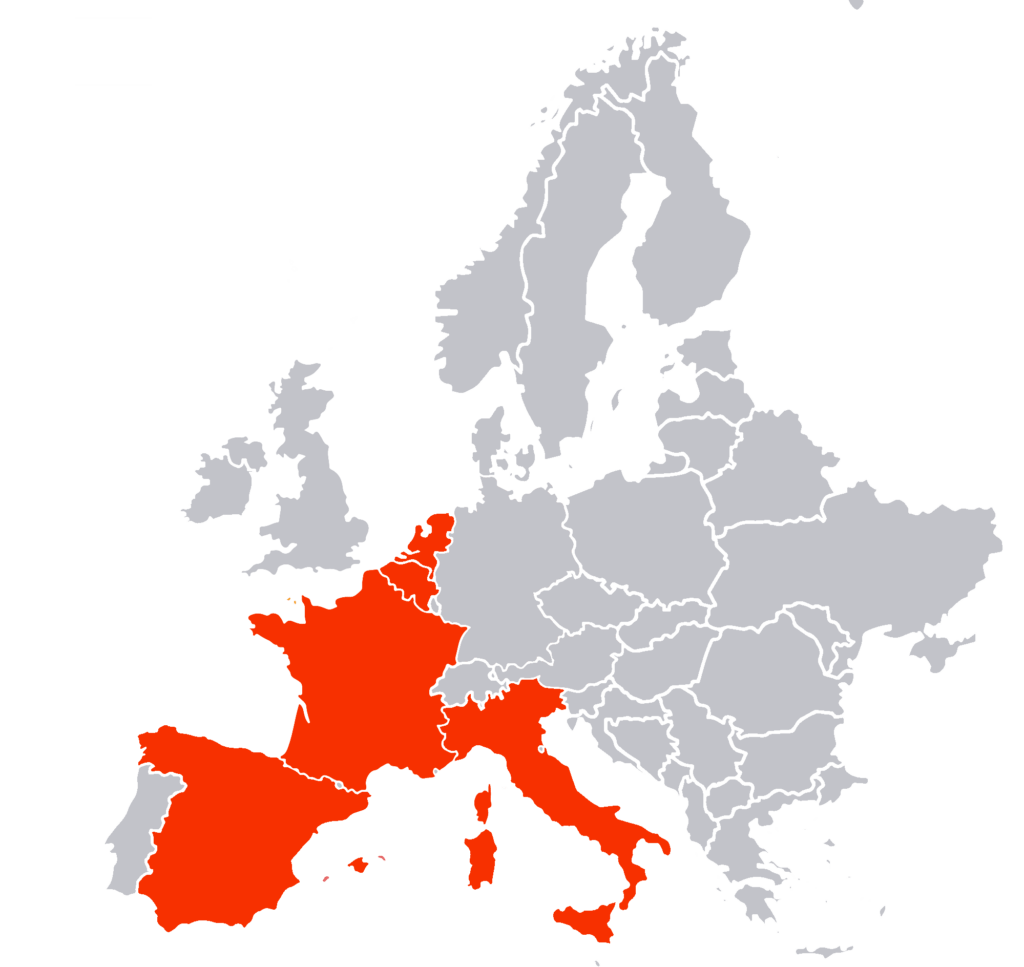

If you are selling to consumers (B2C) sparkling / still wine in europe, you need to appoint a fiscal representative to declare & pay your excise duties & VAT in all EU countries where you are making your sales

B2B sales

B2B sales

If you are selling sparkling / still wine in Europe to professionals with VAT number and no excise one in (B2B) such as restaurants, wine shops, hotels, you can appoint a fiscal representative to help you with your alcohol excise duties

Becompliant for your alcohol excise duties within 5 countries:

100%

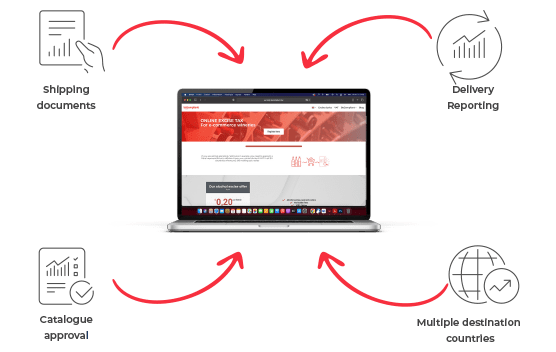

Simple, Fast & 100% Online

Registration & management completely online

Our alcohol excise offer for B2C

from

€

0,20

per Bottle

-

Fiscal representation

-

e-cloud

-

Shipment document SAD

- Alcohol excise payments online

- No hidden fees

- 100% Online

- Pay as you ship

- Instant shipment documents

Our alcohol excise offer for B2B

from

€

19,99

per Shipment

-

Fiscal representation

-

e-cloud

-

Electronic SAD (EMCS)

Coming soon

Our alcohol excise offer

from

€

0,20

per Bottle

-

Fiscal representation

-

e-cloud

-

Shipment document SAD

- Alcohol excise payments online

- No hidden fees

- 100% Online

- Pay as you ship

- Instant shipment documents

.

Contact us

100%